The financial sector is experiencing significant demand for swift and reliable digital services. Customers expect easy online transactions, quick access to their financial data, and strong security to protect their information.

To keep up, financial institutions are working hard to enhance their digital offerings and ensure they effectively meet these expectations. 90% of financial institutions have adopted cloud computing to meet these needs. This technology allows banks to handle large transactions and efficiently manage vast data.

Cloud computing provides the scalability necessary to adapt to fluctuating demands, crucial for maintaining service quality during peak transaction periods. For example,

- After adopting cloud solutions, financial institutions report a 40% increase in transaction handling capacity.

- Since integrating cloud technologies, 70% of banks have observed improved compliance with security regulations. This improvement is vital in protecting sensitive data and maintaining customer trust in an era when cyber threats are increasingly common.

Cloud computing enhances the financial sector by securely managing the increasing volume of digital transactions. This blog will discuss how it transforms operations in banks and financial institutions.

Challenges of Cloud Computing in the Banking Industry

Cloud computing provides significant advantages for banks but introduces several challenges that need careful consideration to ensure operational excellence and regulatory compliance. These challenges can influence a bank’s decision to transition to cloud-based solutions and impact the effectiveness of such technologies once implemented.

Latency Issues

Latency refers to the delay before a data transfer begins following instructions for its transfer. In banking, where real-time processing is crucial, latency can affect transaction speeds and customer satisfaction. To minimize latency, banks can optimize their network infrastructure or choose cloud service providers with data centers geographically closer to their primary user base.

Data Residency and Sovereignty

Data residency is a concern for banks as they often face strict regulations requiring customer data to be stored within certain geographical limits. This stipulation can limit the banks’ choices for cloud services, which may not always align with these legal requirements.

Resilience and Dependency on Providers

Reliance on cloud computing introduces potential risks related to service outages and provider dependencies. Banks must develop strategies to mitigate these risks, such as adopting a multi-cloud strategy or spreading services across multiple data centers. This ensures continuous availability and system resilience if one provider faces disruptions.

Data Privacy and Security

Ensuring the confidentiality and security of customer data in the cloud is paramount. Banks must deploy strong cybersecurity measures and adhere to stringent security protocols to protect sensitive information. This includes implementing end-to-end encryption, regular security audits, and compliance with global security standards.

Regulatory Compliance Challenges

The banking sector is heavily regulated, and complying with these regulations can be more complex in a cloud environment. Financial institutions must ensure that their cloud solutions comply with industry laws and regulations concerning data handling and processing. This often requires additional oversight and adaptation of cloud strategies to fit regulatory frameworks.

Loss of Control

Moving to cloud platforms may result in banks losing control over their IT systems, particularly in managing and monitoring their data and services. To counteract this, banks should seek cloud arrangements that provide enhanced visibility and control over their digital assets, allowing them to maintain robust governance and management practices.

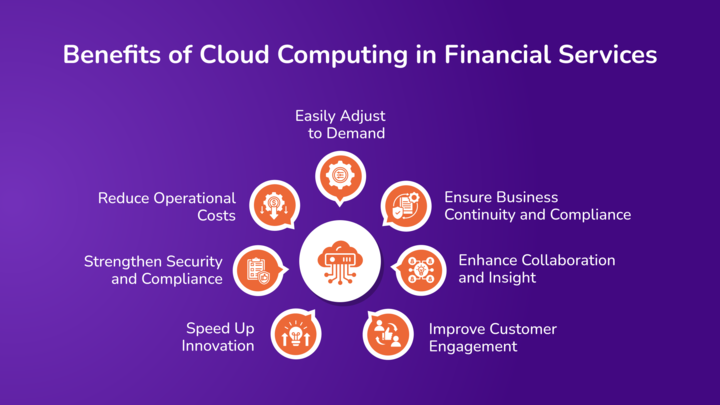

Benefits of Cloud Computing in Financial Services

A recent Gartner report highlights that application modernization is the top priority for cloud adoption among banking and investment services. Let’s delve into how cloud computing can directly benefit your bank, improving operational efficiencies and customer satisfaction.

Easily Adjust to Demand

Quickly scaling resources to meet customer demand is crucial in the financial sector. Cloud computing provides this flexibility, allowing your bank to efficiently manage peak periods—like high-transaction days—without service disruptions. Shifting workloads to a public cloud can boost efficiency by 30% to 40% compared to traditional on-premises hosting solutions.

For example, when transaction volumes spike during the tax season, cloud services can automatically scale up to handle the load, ensuring seamless customer experiences.

Reduce Operational Costs

Migrating to the cloud can significantly cut costs. On average, banks report a 30% reduction in IT expenses by using cloud services as they shift from capital expenditures on hardware to a pay-as-you-go model. This was evident when Bank of America transitioned to a private cloud, saving an estimated $2 billion annually by consolidating data centers and reducing server use.

Strengthen Security and Compliance

Contrary to common concerns, cloud platforms can enhance security. With robust encryption and advanced security protocols, cloud providers protect your data. For instance, using AWS’s cloud services, Capital One enhanced its data encryption and security measures, aligning with global banking security standards and simplifying compliance processes.

Speed Up Innovation

Cloud computing accelerates the deployment of new banking services, enabling swift response to industry shifts and consumer needs. Citibank utilized cloud technology to launch its digital wallet in less than half the usual time, demonstrating how cloud solutions can significantly reduce the time to market for new financial products.

Improve Customer Engagement

With cloud computing, your bank can offer reliable and responsive services across all digital platforms. Thanks to strategically located cloud data centers, customers enjoy quicker access to banking services with reduced latency. This global reach is essential for expanding your customer base and providing consistent service quality, as demonstrated by HSBC’s use of cloud technology to deliver enhanced mobile banking experiences in over 50 countries.

Enhance Collaboration and Insight

Cloud platforms transform how teams collaborate and access data, facilitating real-time interactions and insights. Financial analysts can leverage instant data analytics to make informed decisions, enhancing market responsiveness. JPMorgan Chase, for example, integrates cloud-based tools for real-time data sharing among global teams, improving decision-making and operational efficiency.

Ensure Business Continuity and Compliance

Cloud services help banks meet stringent regulatory requirements and maintain business continuity. Cloud providers regularly update their systems to comply with the latest financial regulations, reducing your bank’s compliance burden. Additionally, cloud-based disaster recovery solutions provide resilience, maintaining operations during outages or disruptions, as seen in Wells Fargo’s use of multi-cloud strategies to safeguard against potential failures.

Choosing the Right Cloud Model for Your Financial Services

Choosing the right cloud model is crucial for financial services that balance security, scalability, and cost-efficiency. Here are the different types of cloud models that are available for financial institutions:

1. Infrastructure as a Service (IaaS)

IaaS provides virtualized computing resources over the Internet. It offers banks a highly scalable and flexible environment in which they only pay for the resources they use.

- Advantages: It enhances the scalability of IT resources, provides significant cost efficiencies, and reduces the need to invest in physical hardware.

- Best For: Banks that require custom applications and flexible data storage solutions to handle large transactions or have fluctuating demand.

2. Platform as a Service (PaaS)

PaaS provides a platform allowing customers to develop, run, and manage applications without the complexity of building and maintaining the infrastructure typically associated with developing and launching an app.

- Advantages: Pre-coded application components simplify application development, reduce time and cost, and ease the burden of managing software updates and hardware maintenance.

- Best For: Banking institutions looking to develop new applications or services quickly without investing in the underlying setups. It’s particularly useful for banks engaging in innovative software development, such as mobile banking or personalized customer service applications.

3. Software as a Service (SaaS)

SaaS delivers software applications over the internet on a subscription basis. It includes everything from hosting to the software itself.

- Advantages: It offers banks an easy-to-use and manageable solution without the overheads associated with maintenance and upgrades, and it ensures that the applications are always up-to-date with the latest features and security standards.

- Best for: Banks need reliable and secure applications for CRM, enterprise resource planning, or customer financial interactions without the hassle of managing the infrastructure or updates.

| Service Model | What It Provides | What You Manage | Ideal Use-Case in Banking | |

| IaaS | Virtual servers, storage, networks | Applications, data | Custom application hosting, scalable storage solutions | |

| PaaS | Development tools, operating systems, hosting | Applications | Rapid development of banking applications and services | |

| SaaS | Complete applications | None (handled by the provider)

|

Standard banking applications like CRM and data analysis |

When choosing a cloud computing model, consider these factors:

- Regulatory Compliance: Ensure that the service provider meets the banking regulations applicable in your jurisdiction, particularly for data security and privacy.

- Scalability and Flexibility: Assess whether the model supports your bank’s growth and fluctuation in demand without incurring unnecessary costs.

- Technical Expertise: Determine the level of internal expertise required to manage the services and whether your bank has the resources to handle it.

Application of Cloud Computing in the Financial Sector

Here’s a detailed overview of how various cloud computing applications enhance financial services’ capabilities.

Enhancing Digital Financial Services

Cloud computing is the backbone of digital financial platforms, offering customers online and mobile banking experiences.

- It enables financial institutions to deliver services directly to consumers’ devices, such as account management, real-time transaction monitoring, mobile payments, and digital wallets.

- This digital shift enhances customer convenience and expands financial services’ reach to underserved populations.

Advancing Data Analytics

Financial institutions use cloud computing to perform sophisticated data analyses that provide insights into market trends, customer behavior, and product performance. These analytics help banks and insurance companies develop targeted products and strategies, enhance customer engagement, and expand market share by aligning offerings with consumer needs.

Improving Fraud Detection

Cloud computing enables the analysis of vast datasets to identify and flag unusual transaction patterns in real-time, thereby preventing potential fraud. This proactive approach protects the institution’s assets and safeguards customer trust.

Centralizing Customer Relationship Management (CRM)

Cloud-based CRM systems are pivotal for managing and analyzing customer interactions and data throughout the lifecycle. By centralizing this information, financial institutions can deliver personalized services and optimize marketing strategies, enhancing customer relationships and retention.

Facilitating Operational Synchronization

Adopting cloud services improves the synchronization across various operational units within financial institutions. Cloud tools facilitate the seamless exchange of information and collaboration across departments, leading to more integrated and efficient operations.

Cloud computing is crucial in the financial sector’s digital transformation, driving innovation, efficiency, and security.

Why Choose an AWS Consulting Partner for Cloud Transformation?

Selecting the right AWS consulting partner can make all the difference in a successful cloud transformation, especially for industries like financial services that require precision, compliance, and security.

- Expert Knowledge: AWS partners understand AWS storage, computing, and AI/ML tools. They design cloud setups to fit your needs, boosting performance and cutting costs.

- Best Practices: They use the AWS Well-Architected Framework to ensure your cloud setup is secure, reliable, and meets industry standards.

- Cost Management: AWS partners help manage cloud expenses by adjusting resources, identifying savings, and using cost-effective options like reserved instances.

- Security and Compliance: They ensure your cloud setup meets strict security standards and complies with regulations like GDPR and PCI-DSS.

- Simplified Migration: AWS partners guide you through moving applications to the cloud, using tools like the AWS Migration Acceleration Program (MAP) to make the process faster and easier.

As an AWS partner, Avahi provides tailored support for financial operations, ensuring a secure and scalable cloud setup. With expertise in cost optimization, application modernization, and compliance, Avahi simplifies your cloud journey, allowing your business to focus on growth and innovation.

Modernize Your IT Infrastructure with Avahi’s Support

Avahi specializes in delivering innovative cloud solutions that address your unique business challenges. As your dedicated AWS Cloud Consulting Partner, we are committed to simplifying your cloud journey through seamless adoption, migration, and application modernization.

Our Services Include:

- Adoption and Migration: Migrate your legacy applications or workloads to AWS for enhanced reliability, scalability, and performance.

- DevOps: Unlock the power of your data with advanced analytics and machine learning capabilities.

- Cloud Staffing Services: Access top-tier talent to support and drive your initiatives, ensuring a seamless and effective cloud transformation.

Want to explore how Avahi can help you simplify, modernize, and excel in your cloud journey?

Book your strategy session with us today.