Customer expectations in banking have changed. Over 70% of banking customers now prefer digital self-service channels over conventional ones, looking for quick, convenient, and reliable service across digital channels. At the same time, banks face growing pressure to reduce operational costs, meet compliance standards, and compete with agile, tech-driven players.

Artificial Intelligence (AI) is central in helping financial institutions meet these demands. It enables faster decision-making, automates repetitive processes, and improves overall service quality.

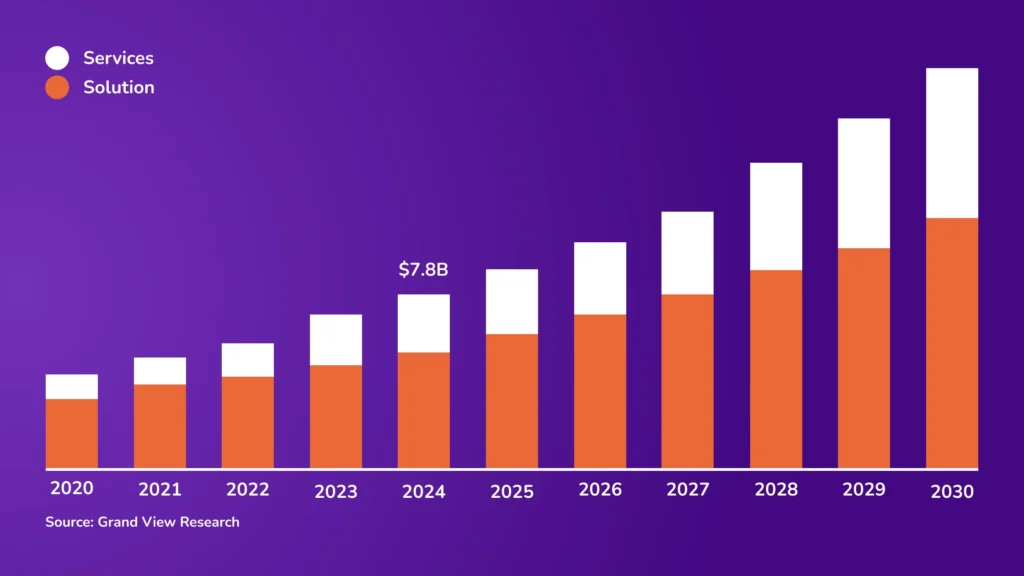

One of the most practical applications of AI in banking is using chatbots. The global chatbot market size was estimated at USD 7.76 billion in 2024 and is expected to grow at a CAGR of 23% from 2025 to 2030, making it one of the most impactful technologies of this decade.

AI-powered chatbots allow banks to deliver real-time support, streamline operations, and enhance customer engagement without adding pressure to internal teams. This means faster service, better resource allocation, and improved bank operational control.

In this blog, we will explore how AI chatbots modernize banking customer support, their use cases, the benefits they offer, and the challenges banks face during implementation.

Understanding Banking Chatbots

Banking chatbots are AI-powered virtual assistants designed to interact with customers through text or voice, providing instant support and automating routine banking tasks. They use technologies like Natural Language Processing (NLP) and Machine Learning to understand customer queries, identify intent, and deliver accurate responses in real time.

These chatbots can handle various services, such as checking account balances, processing fund transfers, offering product information, and even providing essential financial advice. By operating across web, mobile apps, and messaging platforms, banking chatbots improve service availability, reduce wait times, and streamline customer interactions efficiently.

Benefits of AI Chatbots in Modern Banking

Here are the advantages of deploying chatbots in the banking sector:

1. 24/7 Customer Service Availability

AI chatbots ensure that customers receive assistance anytime without being limited by business hours. This constant availability improves response times and eliminates long hold times.

2. Personalized Financial Assistance

An Accenture study found that personalized chatbot interactions can increase customer retention by 25%, showing how chatbots keep customers happy and engaged. With access to transaction history and behavioral data, chatbots can deliver tailored recommendations and financial insights.

They help users manage spending, suggest relevant products, and offer reminders for due payments or renewals. This improves customer engagement and satisfaction without increasing staffing costs.

3. Operational Cost Reduction

Chatbots reduce the volume of queries that reach human agents, allowing banks to scale support operations without proportionally increasing headcount. Implementing AI chatbots can reduce customer service expenses by up to 30%, leading to significant operational cost savings for banks.

4. Real-Time Customer Insights

Every chatbot interaction provides data on customer behavior, preferences, and concerns. Banks can use this data to identify service gaps, improve product offerings, and make informed business decisions. This feedback loop enables continuous service improvement.

5. Faster Query Resolution

AI chatbots instantly resolve common queries, such as balance checks, loan application statuses, or transaction issues. This reduces customer effort and increases first-contact resolution rates, essential metrics in improving customer experience.

6. Improved Consistency and Compliance

Chatbots deliver uniform responses, reducing human errors and ensuring consistent adherence to internal policies and regulatory standards. This is especially important in environments that require strict compliance, such as handling disclosures or sensitive financial instructions.

7. Multilingual Support for Diverse Customers

AI chatbots can be trained to support multiple languages, ensuring effective communication with a diverse customer base. This broadens the bank’s reach and improves accessibility for users in different regions or with varying language preferences.

Use Cases of AI Chatbots in Banking

All of the top 10 largest U.S. commercial banks now use chatbots as part of their customer service channels. These bots are transforming banking by increasing efficiency, minimizing human error, and ensuring round-the-clock service availability. Let’s explore some important use cases where these chatbots are actively deployed.

1. Customer Support

AI chatbots automate routine service tasks, reducing call center load and improving response times. Customers can access real-time account balances and transaction histories through simple queries, eliminating the need to navigate complex apps or wait in call center queues.

Bots also support transactional functions, such as fund transfers and bill payments, all within the chat interface. Chatbots provide guided troubleshooting when issues like locked accounts or failed transactions arise, reducing user downtime. This automation speeds up service delivery and allows human agents to focus on more complex, high-touch scenarios.

2. Loan & Mortgage Application Support

Chatbots simplify the application process by acting as always-on assistants. They explain loan products, collect required documents, and answer queries about terms and eligibility, cutting down customer wait times and application drop-offs.

Chatbots can pre-screen users based on predefined criteria and guide them through eligibility checks, minimizing friction early in the process. They explain loan types, interest rates, and repayment options in real time, enabling users to make informed decisions.

These bots send automated reminders for pending documentation, allowing applicants to track their application status anytime. The chatbot can escalate the conversation to a human agent for more support. These tools increase application completion rates and shorten processing times by offering consistent, real-time assistance.

3. Fraud Detection & Prevention

AI chatbots are instrumental in detecting and mitigating fraud in real time. A study by Forrester indicates that AI-powered systems can reduce fraud losses by 15-25% compared to rule-based systems. These systems excel in real-time anomaly detection and adaptive learning, keeping them ahead of evolving fraud tactics.

Analyzing user behavior and transaction patterns, they identify anomalies such as multiple high-value transactions or logins from unrecognized devices and immediately trigger alerts. If risk thresholds are exceeded, the chatbot can initiate protective actions like temporarily freezing the account or enforcing step-up authentication using OTPs or biometrics. They also assist customers in reporting fraud, guiding them through verification and resolution workflows. This engagement protects sensitive financial data and ensures customer trust in the institution’s security measures.

4. Lead Generation & Product Recommendations

Using NLP and intent recognition, the chatbot collects relevant contact details and preferences as users inquire about products or services, feeding this data directly into the bank’s CRM for follow-up.

Based on the user’s financial behavior and profile, the chatbot can suggest tailored product recommendations, such as pre-approved credit cards or personalized savings plans. This targeted strategy enhances customer engagement and supports conversion without manual intervention from sales teams.

5. Notifications & Alert Management

Timely alerts help users manage their financial responsibilities and reduce reliance on manual reminders. Chatbots notify users and ensure timely responses. Bots send proactive reminders for upcoming payments, such as loan EMIs or credit card dues, helping users avoid penalties and maintain healthy credit scores.

They also provide real-time updates about account activity, including deposits, withdrawals, and unusual transactions. Beyond transactional alerts, chatbots can notify users of KYC deadlines, product maturity dates, and promotional offers. This continuous, context-aware communication enhances financial planning and strengthens the user-bank relationship.

6. Feedback Collection & Service Quality Monitoring

Post-interaction surveys via chatbot help banks assess service quality and address gaps before they escalate.

After necessary actions, like completing a transaction or resolving a query, the bot can prompt users to rate their experience or provide comments. These responses are captured and aggregated to assess customer satisfaction, identify service gaps, and inform product improvements.

With built-in sentiment analysis, AI platforms can detect negative trends early, enabling teams to act proactively. This structured feedback loop improves customer experience and supports compliance with quality assurance standards.

Challenges in AI Chatbot Adoption for the Banking Sector

Below are the core challenges financial institutions must address to successfully deploy AI chatbots while maintaining customer trust, operational efficiency, and regulatory compliance.

1. Limited Availability of Human Customer Support

Customers expect quick resolutions, especially when dealing with sensitive banking issues like loan processing, account security, or transaction failures. However, human customer support teams can’t be available around the clock.

Delays in resolving service tickets, especially outside standard hours, negatively affect the customer experience. Most customers rank timely issue resolution as their top priority when evaluating service quality. This unmet demand highlights the need for 24/7 intelligent support, which AI chatbots can fulfill if implemented correctly.

2. Data Privacy and Security Concerns

Banks manage sensitive financial information, making data privacy one of the most critical concerns in AI implementation. Any breach, whether due to system vulnerabilities or third-party integrations, can damage customer trust and expose institutions to legal consequences. Banks must ensure that AI platforms offer strict data-handling protocols to address this.

Solutions that support on-premise deployment give banks complete control over how data is stored and accessed. The chatbot infrastructure must comply with financial data protection standards such as GDPR, PCI DSS, and local regulations to avoid penalties and reputational damage. Securing the entire lifecycle of customer interaction is non-negotiable.

3. Balancing Automation with Human Interaction

While automation improves efficiency, not every customer query can or should be handled by a bot. Situations involving fraud, legal disputes, or emotional distress require human empathy and complex decision-making. Banks must implement escalation protocols that allow seamless handover from chatbot to human agent when necessary. This ensures customers receive the right level of support without feeling stuck in an automated loop.

Chatbot conversations should align with the bank’s tone and service approach, maintaining a personal touch even in automated flows. Continuous training and feedback mechanisms help improve bot responses over time while preserving quality.

4. Meeting Regulatory and Compliance Requirements

The banking sector is heavily regulated, with frameworks like KYC (Know Your Customer), AML (Anti-Money Laundering), and data retention policies shaping every customer interaction. Chatbots must be built to operate within these legal frameworks. T

his includes validating user identities, logging all interactions for audit purposes, and flagging suspicious activity in real time. Regulatory updates are frequent, so banks need chatbot platforms that are flexible and easy to update as compliance rules change. Failing to design bots with compliance in mind can expose banks to legal and financial risks.

5. Handling Unstructured and Disconnected Data

Banks deal with large volumes of data across systems, loan documents, account activities, and customer histories, but much of this information is unstructured and scattered. Traditional systems don’t support real-time access or centralized insights.

Chatbots depend on accurate, timely data to provide meaningful responses. Without proper data integration, bots may deliver generic or incorrect answers. To address this, banks must build backend systems that allow AI chatbots to access and organize data efficiently, ensuring fast and relevant customer interactions.

6. Absence of Omnichannel Support

Modern banking customers interact with banks across multiple platforms—mobile apps, websites, social media, and messaging apps. However, many banks still operate in silos, providing fragmented experiences across channels.

Without omnichannel support, customers have to repeat information every time they switch platforms, which leads to frustration. AI chatbots should be designed to deliver consistent, context-aware support across all channels. This unified approach ensures that no matter where the customer starts the conversation, their history, preferences, and open issues are always available.

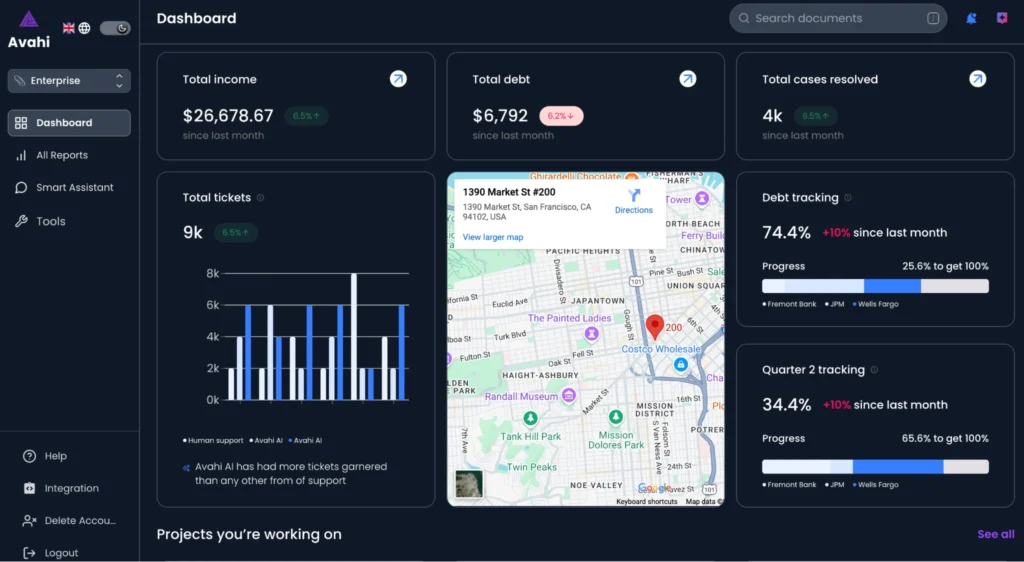

Enhancing Banking Operations with the Avahi Gen AI Platform

Here are some essential features of the Avahi Gen AI platform that could significantly enhance customer support and operations within the banking sector:

Customizable Dashboard

The Avahi AI Platform combines advanced AI capabilities to meet the operational and regulatory demands of the finance industry. The customizable dashboard of the Avahi Gen AI platform helps streamline workflows and enhances scalability in operations. It allows you to effectively track crucial metrics through a dashboard specifically configured to meet your unique business requirements.

Smart Assistant

Avahi’s smart assistant is a dynamic feature capable of understanding customer intent and context. For complex cases, it enables seamless escalation to human agents while preserving conversation history, ensuring a smooth handoff and consistent customer experience.

Structured Extraction

Banks deal with large volumes of documents such as KYC forms, loan applications, and compliance reports. Avahi AI platform simplifies this by enabling structured data extraction from uploaded documents and reducing manual processing and error rates. This streamlines workflows like onboarding, document verification, and regulatory checks.

PDF Summarizer

The Smart Summarizer feature of the Avahi Gen AI platform significantly enhances and streamlines your interaction with documents. It allows for the upload of multiple PDF files, providing a seamless way to manage and access your documents. Additionally, you can pose questions and receive precise citations linking back to the exact source of information within the same PDF, ensuring efficient information retrieval and verification.

Data Masking and Face Recognition

Security is important in financial services. Avahi’s data-masking feature automatically protects sensitive customer information like account numbers, personal identifiers, and transaction data during storage and processing. This reduces the risk of data leaks and supports compliance with data protection laws like GDPR and PCI DSS. Face recognition helps reduce fraud by confirming user identity before proceeding with sensitive operations.

CSV Querying

Banking teams often work with large datasets, transaction logs, risk assessments, or customer records in CSV format. Avahi Gen AI platform enables users to query CSV files directly through a natural language interface, providing instant insights without manual spreadsheet filtering. This accelerates decision-making and supports analytics-driven operations.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions include:

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency? Get Started with Avahi’s AI Platform!