Fraud and cyber threats continue to grow more complex, and the financial sector is feeling the pressure.

According to the 2024 Association of Certified Fraud Examiners (ACFE) report, fraud costs the global financial industry an estimated $4.7 trillion annually. At the same time, IBM’s 2024 Cost of a Data Breach Report ranks financial services among the most frequently targeted industries, with the average breach costing $4.8 million—more than nearly any other sector.

Yet, many banks still rely on outdated fraud detection systems that simply can’t keep pace with the speed, scale, and complexity of modern attacks. Static, rule-based models, manual investigations, and slow alerts leave dangerous gaps, while false positives from these systems frustrate customers and drain internal resources.

To stay ahead, banks are turning to Generative AI (GenAI): intelligent, adaptive systems capable of analyzing vast volumes of data in real time, detecting intricate fraud patterns, and evolving with emerging threats. GenAI-powered chatbots can improve fraud detection, safeguard sensitive data, and support regulatory requirements when designed with compliance at the core—especially with standards like PCI DSS (Payment Card Industry Data Security Standard).

This blog explores how PCI DSS-compliant GenAI chatbots are reshaping fraud detection in banking. We’ll also examine the operational challenges financial institutions must navigate and introduce the Avahi GenAI Platform—a secure, scalable solution purpose-built for the evolving needs of financial services.

Why Are PCI DSS-Compliant GenAI Chatbots Important for the Finance Industry?

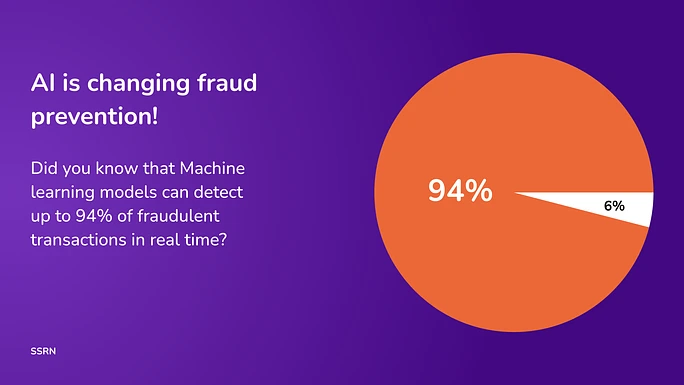

Generative AI (GenAI) refers to artificial intelligence systems that can create new content based on patterns in existing data. In banking, GenAI improves efficiency and decision-making across various functions. Common use cases include customer service automation through AI chatbots, document summarization and data extraction from forms, and detecting unusual transaction patterns that may indicate fraud.

PCI DSS is a set of security requirements to protect cardholder data during processing, storage, and transmission. Compliance with PCI DSS is mandatory for banks and financial institutions. It ensures that sensitive payment information is handled securely, reducing the risk of breaches and fraud. GenAI chatbots help them meet strict data protection standards while improving fraud detection and customer service.

Strong data encryption, access control, secure authentication, audit logging, and regular system testing are essential requirements for chatbot deployment. These controls help ensure that AI-driven systems do not compromise sensitive financial data.

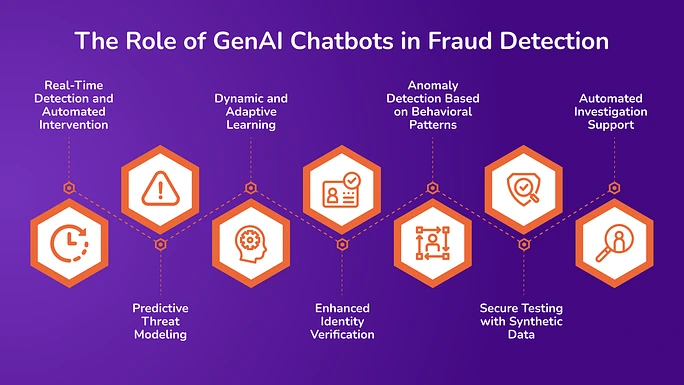

The Role of GenAI Chatbots in Fraud Detection

GenAI chatbots are increasingly central to how financial institutions detect and prevent fraud. Here are a few areas where they’re creating a measurable impact:

1. Real-Time Detection and Automated Intervention

GenAI chatbots can monitor transactions and customer interactions as they happen. When a transaction deviates from known patterns, such as a card used in a new location or an unusual purchase amount, the system can flag or block it immediately without human input.

This real-time response reduces potential losses and ensures that threats are addressed before they escalate. Automated handling also reduces pressure on fraud teams by filtering out clear-cut cases.

2. Predictive Threat Modeling

GenAI can forecast likely fraud patterns by analyzing historical data and current trends. It doesn’t just react to fraud but helps anticipate it. This includes identifying seasonal spikes or emerging attack vectors before they cause significant harm.

This predictive capability allows fraud teams to allocate resources, set up preemptive rules, and adjust thresholds in anticipation of high-risk periods.

3. Dynamic and Adaptive Learning

GenAI systems evolve with every new data point. They use supervised, unsupervised, semi-supervised, and reinforcement learning to stay current with changing fraud techniques.

This adaptability means the system can detect previously unknown threats and adjust quickly to new fraud patterns without waiting for manual updates.

5. Enhanced Identity Verification

GenAI enhances security through intelligent identity verification. It supports biometric authentication, behavioral biometrics, and multi-factor authentication (MFA). To assess legitimacy, these techniques analyze how users interact with devices, such as typing speed or screen pressure.

Combined with regular credentials, these methods provide an extra layer of protection and make it harder for attackers to impersonate users.

6. Anomaly Detection Based on Behavioral Patterns

GenAI can quickly identify deviations by understanding what normal behavior looks like for individual customers. These anomalies may include transaction location, frequency, or timing changes inconsistent with past behavior.

Even when fraudulent activity mimics legitimate behavior, these systems can uncover certain inconsistencies that warrant further investigation.

7. Secure Testing with Synthetic Data

Generative AI can create synthetic datasets that simulate real-world fraud scenarios. These datasets allow fraud detection models to be trained and tested without exposing real customer data.

This method helps financial institutions develop and validate detection systems in a controlled environment, reducing risk and improving model performance.

8. Automated Investigation Support

GenAI speeds up the fraud investigation process by generating reports, highlighting suspicious patterns, and organizing key insights for fraud analysts. This automation cuts down the time needed to respond to incidents.

It also enhances investigative depth by connecting data points and identifying relationships that may not be obvious through manual review.

Benefits of Using PCI DSS-Compliant GenAI Chatbots in Fraud Detection

Below are the benefits of using GenAI chatbots in the banking sector:

1. Increased Speed and Accuracy in Threat Detection

GenAI chatbots process high volumes of transaction data in real time, allowing them to detect and respond to threats much faster than manual systems. This speed is critical in preventing fraud losses.

According to a 2023 McKinsey report, AI-driven fraud detection systems can reduce the average time to detect fraud from 24–48 hours to under 30 minutes. Additionally, the same report found that detection accuracy improved by up to 90% when AI models were used instead of traditional rule-based systems. Faster and more accurate detection reduces fraud incidents’ financial impact and duration.

2. Reduction in False Positives

False positives are legitimate transactions flagged as fraudulent and are a major drain on resources and a source of customer dissatisfaction. GenAI chatbots reduce false positives by learning from historical data and adjusting risk assessments accordingly.

Industry studies show that AI systems can reduce false positives by up to 85%. This reduction means fewer unnecessary transaction blocks, fewer customer complaints, and less time wasted on manual reviews of non-fraudulent activity. The result is a more efficient fraud prevention operation and an improved customer experience.

3. AI-Generated Insights

GenAI chatbots enhance the capabilities of fraud analysts rather than replacing them. AI systems surface meaningful insights, such as behavioral anomalies, transaction linkages, and emerging fraud trends, allowing analysts to make informed decisions faster.

A survey by SAS and Chartis Research found that financial institutions using AI tools reported a marked improvement in the effectiveness of their fraud investigation teams. AI-generated insights free analysts from low-value tasks and give them the data they need to focus on high-risk cases.

4. Lower Operational Costs Through Automation

Automating fraud detection and response processes significantly lowers the cost of fraud prevention operations. GenAI filters and prioritizes alerts, reducing the need for large manual review teams.

According to IBM’s 2024 Cost of a Data Breach Report, organizations using AI and automation in their fraud response reduced average fraud-related costs by $1.76 million compared to those without AI tools. Cost savings come from fewer false alarms, quicker investigations, and reduced fraud losses.

GenAI allows financial institutions to scale fraud prevention efforts without proportionally increasing headcount or operational expenses by automating high-volume, repetitive tasks.

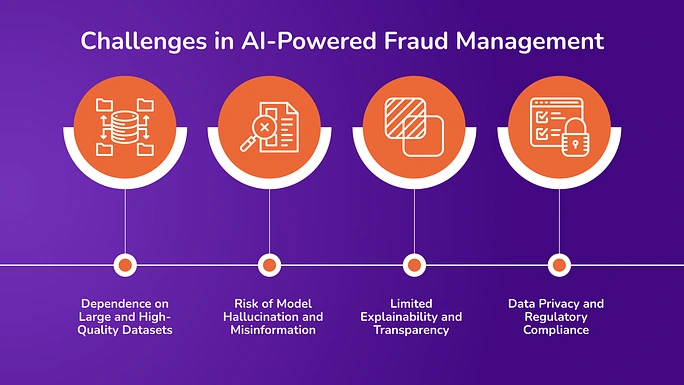

Challenges in AI-Powered Fraud Management

According to Statista, payment card fraud, including credit and debit cards, is expected to increase by over $10 billion between 2022 and 2028. This sharp rise highlights the growing need for advanced fraud prevention solutions.

While AI is critical in detecting and preventing fraud, financial institutions face several challenges in effectively deploying these systems.

1. Dependence on Large and High-Quality Datasets

AI systems require access to large volumes of high-quality data to function effectively. In fraud detection, this means diverse, labeled transaction data that includes legitimate and fraudulent activity. AI models may produce inaccurate results without enough data or miss critical fraud patterns.

Financial institutions must invest in data collection, labeling, and preprocessing processes to ensure models are trained on reliable inputs. Synthetic data can help fill gaps but cannot fully replace real-world examples.

2. Risk of Model Hallucination and Misinformation

Generative AI can sometimes produce plausible but incorrect outputs, a phenomenon known as hallucination. In fraud detection, this can lead to false alarms or overlooking genuine threats.

To reduce this risk, AI models must be tightly integrated with structured data systems, and their outputs should be validated through rules or human review in high-risk cases. Continuous performance monitoring is also essential.

3. Limited Explainability and Transparency

Understanding how AI models arrive at a decision is often difficult, especially with complex models like deep learning. This lack of transparency makes it challenging for fraud analysts and compliance teams to trust the system’s decisions.

To address this, institutions should use explainable AI (XAI) techniques that provide clear reasons for alerts or risk scores. Explainability is also essential for regulatory compliance and customer trust.

4. Data Privacy and Regulatory Compliance

While PCI DSS governs the handling of cardholder data, AI systems often process a broader range of customer information, including behavioral and biometric data. This raises additional privacy concerns.

Organizations must ensure AI systems comply with PCI DSS and broader privacy regulations like GDPR or CCPA. This includes securing data, managing consent, and limiting data access.

How is the Avahi Gen AI Platform Shaping the Future of Secure and Scalable Banking?

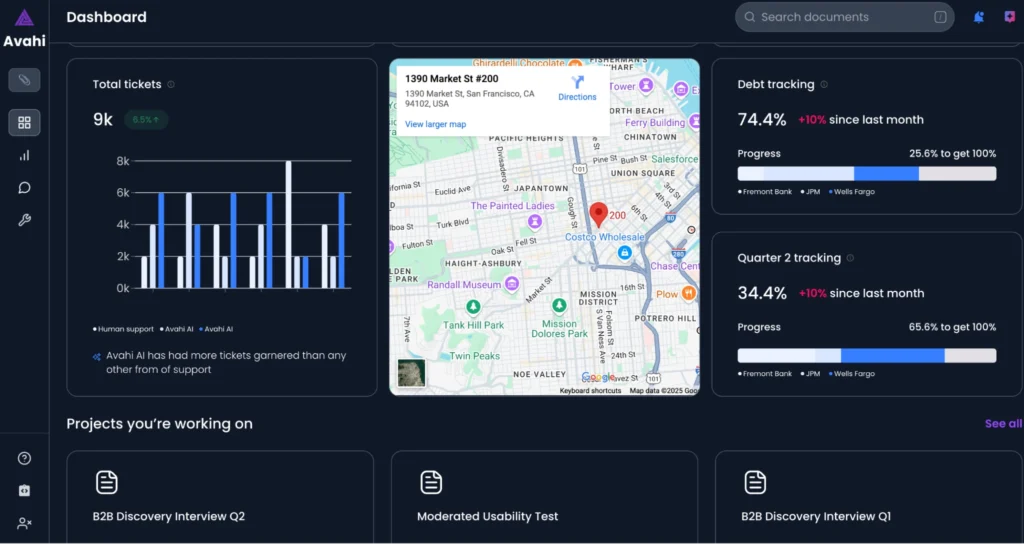

The Avahi AI Platform offers practical solutions to banks’ fraud detection, compliance, and operational efficiency challenges. It is designed to support secure, scalable, and regulation-aligned banking environments.

Improved Operational Efficiency

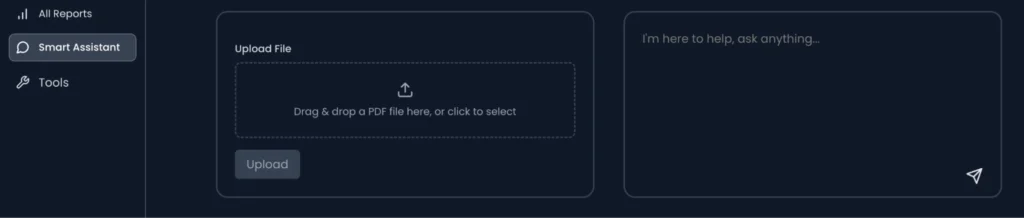

The platform’s customizable dashboard enables banks to track the most important metrics to their operations. Teams can configure the dashboard to monitor fraud alerts, compliance statuses, and customer service KPIs. This streamlines workflow management and supports scalability as institutions grow or face increasing transaction volumes.

Automated Data Extraction

Banks deal with high volumes of documents, including KYC forms, loan agreements, and compliance reports. Avahi’s structured extraction feature automates the capture of relevant data fields, minimizing manual input and reducing the risk of human error. This speeds up onboarding and simplifies audit preparation.

Enhanced Customer Support

Avahi’s AI-powered chatbot understands customer intent and context, enabling accurate and responsive support. In cases requiring human intervention, it seamlessly ends the conversation, preserving chat history for continuity. This improves response time and customer satisfaction while reducing pressure on human agents.

Secured Data Handling

Data privacy is a top concern in financial services. Avahi addresses this with automatic data masking that protects sensitive information like account numbers and personal identifiers during processing. Additionally, face recognition helps verify user identity before allowing high-risk operations, reducing fraud and unauthorized access.

Simplified Compliance and Document Review

The PDF summarizer lets users upload and query documents directly, returning answers with precise source citations. This is especially useful for regulatory teams reviewing policy documents or internal reports, reducing time spent searching for critical information.

Discover Avahi’s AI Platform in Action

At Avahi, we empower businesses to deploy advanced Generative AI that streamlines operations, enhances decision-making, and accelerates innovation—all with zero complexity.

As your trusted AWS Cloud Consulting Partner, we empower organizations to harness AI’s full potential while ensuring security, scalability, and compliance with industry-leading cloud solutions.

Our AI Solutions Include

- AI Adoption & Integration – Utilize Amazon Bedrock and GenAI to enhance automation and decision-making.

- Custom AI Development – Build intelligent applications tailored to your business needs.

- AI Model Optimization – Seamlessly switch between AI models with automated cost, accuracy, and performance comparisons.

- AI Automation – Automate repetitive tasks and free up time for strategic growth.

- Advanced Security & AI Governance – Ensure compliance, fraud detection, and secure model deployment.

Want to unlock the power of AI with enterprise-grade security and efficiency?

Get Started with Avahi’s AI Platform!